Industry Research

Home Professionals Navigate Continued Economic Challenges

Firms expect tariffs, inflation and other factors to impact business, the Q3 2025 U.S. Houzz Renovation Barometer shows

The quarterly U.S. Houzz Renovation Barometer asks more than 1,000 construction and architecture and design firms on Houzz about their expected, current and recent business activity. The Q3 2025 Barometer, fielded June 14-July 1, 2025, also asked pros how they expect local and national economic factors — including tariffs, inflation and labor shortages — to impact their businesses and the industry at large.

The just-released report reveals that the vast majority of firms across the industry expect these factors to negatively impact business in Q3. This is consistent with reduced optimism industrywide as business activity slows, though more pros still expect business performance to improve overall this quarter than anticipate a decline.

Here are more insights into construction and design businesses’ outlooks in the face of ongoing economic uncertainty.

The just-released report reveals that the vast majority of firms across the industry expect these factors to negatively impact business in Q3. This is consistent with reduced optimism industrywide as business activity slows, though more pros still expect business performance to improve overall this quarter than anticipate a decline.

Here are more insights into construction and design businesses’ outlooks in the face of ongoing economic uncertainty.

Other local or national factors expected to impact business in Q3 include:

More for Pros on Houzz

Read more stories for pros

Learn about Houzz Pro software

Talk with your peers in pro-to-pro discussions

- Inflation (42% construction, 46% design)

- Hesitation from clients when committing to projects (38% construction, 37% design)

More for Pros on Houzz

Read more stories for pros

Learn about Houzz Pro software

Talk with your peers in pro-to-pro discussions

Tariffs are the top concern. In Q3, the most-reported factor expected to hinder business across both sectors was tariffs (48% construction, 59% design).

Professionals anticipate that a variety of materials will be affected. Pros are most concerned about tariffs on lumber or plywood (66% construction, 68% design), steel (56% construction, 65% design), flooring (50% construction, 60% design) and aluminum (41% construction, 43% design).

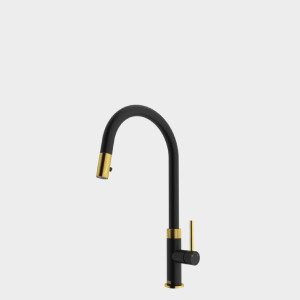

They’re concerned about the impact on products too. This quarter, businesses in the design sector anticipate tariffs to impact lighting fixtures (73%), appliances (71%) and indoor furniture (65%). Construction businesses are concerned about appliances (68%), plumbing fixtures (56%), cabinetry (55%) and HVAC systems (44%).

Home Professionals Grow More Cautious as Business Activity Slows